Obtaining a mortgage has become increasingly complex and difficult because of the increased assessment on affordability and the individual credit files. Most lenders in the market have reacted to their regulatory responsibilities by introducing tighter controls and checks. It has therefore never been as important to be aware of the many rules, regulations and pitfalls when applying for a mortgage. The range of options is much greater and it is difficult to ensure that you are making the right choice and getting the best and most appropriate mortgage to suit your needs. That is why we would always recommend using an independent financial adviser as we will always put the client at the centre of the process, and find the best mortgage for their lifestyles.

Obtaining a mortgage has become increasingly complex and difficult because of the increased assessment on affordability and the individual credit files. Most lenders in the market have reacted to their regulatory responsibilities by introducing tighter controls and checks. It has therefore never been as important to be aware of the many rules, regulations and pitfalls when applying for a mortgage. The range of options is much greater and it is difficult to ensure that you are making the right choice and getting the best and most appropriate mortgage to suit your needs. That is why we would always recommend using an independent financial adviser as we will always put the client at the centre of the process, and find the best mortgage for their lifestyles.

- Remortgages

- First time buyers

- Buy to let – the Financial Conduct Authority does not regulate some forms of Buy to Lets

- Self build mortgages

- Mortgages that set off your savings

- Lifetime mortgages (for the elderly, to understand the features and risks of a lifetime mortgage ask for a personalised illustration). CHECK THAT THIS MORTGAGE WILL MEET YOUR NEEDS IF YOU WANT TO MOVE OR SELL YOUR HOME OR YOU WANT YOUR FAMILY TO INHERIT IT. IF YOU ARE IN ANY DOUBT, SEEK INDEPENDENT ADVICE.

- Equity release could involve a lifetime mortgage or home reversion plan. To understand the features and risks of these products ask for a personalised illustration.

For more information please contact us and we will respond to you as soon as possible.

Your home may be repossessed if you do not keep up repayments on your mortgage.

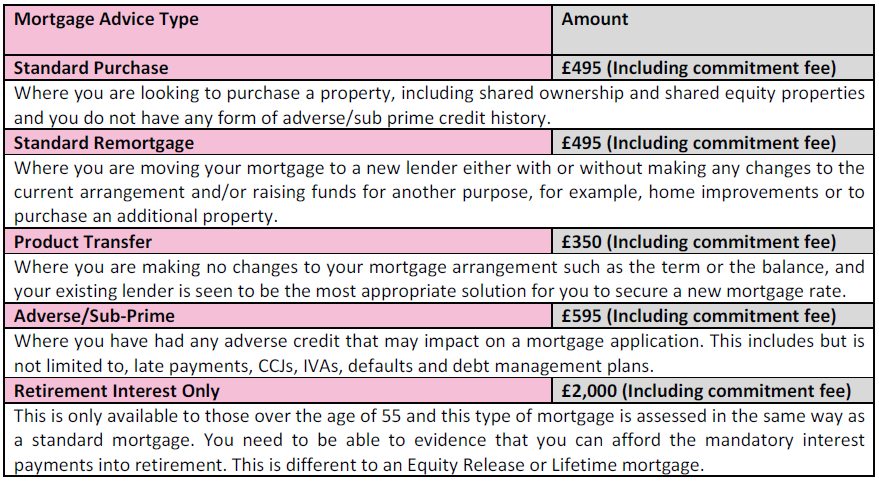

The initial consultation and research is provided free of charge. We can confirm that Absolute Sense Independent Financial Advisers Ltd will charge the following fee options which will depend upon the product recommended. The table below details the fees that would be payable: